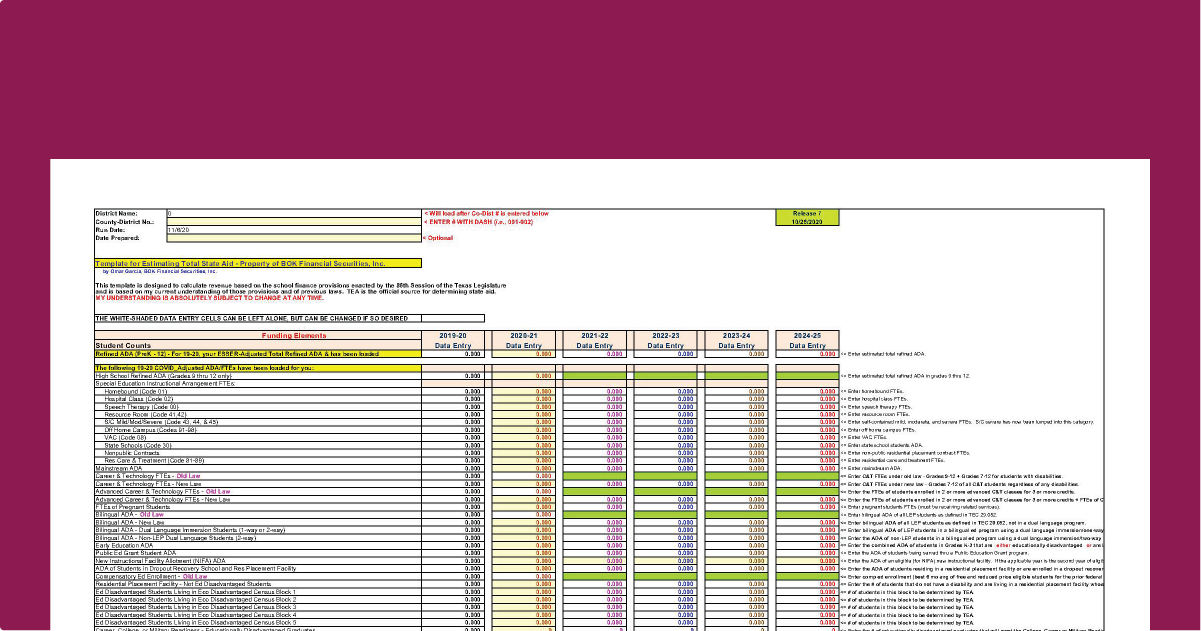

Template for Estimating State Aid

This Excel template is designed to help develop annual budgets, monitor over/under state aid payments during the year, and for long-range planning, as it typically gives users the ability to project state aid for at least four subsequent school years. Developed and maintained by Omar Garcia of BOK Financial Securities, Inc., we are the sole source provider of this template and have been granted permission to share exclusively.

Current Releases

HB 2 Template: R3 Dated 06/23/2025

This release corrects some errors that were discovered related to the Fast Growth Allotment and the Additional State Aid for Homestead Exemption (ASAHE) allotment - please read the Notes tab before entering data. Again, please be advised that all the calculations are subject to change, so as always, be on the lookout for future releases.

Previous Releases

Previous releases from the 2024-2025 fiscal year will be available until March 2026.

R2 Dated 06/15/2025, This release corrects some errors that were discovered in the first release and updates some of the allotments as well - please read the Notes tab before entering data. Again, please be advised that all the calculations are subject to change, so as always, be on the lookout for future releases. If you are a fast growth district, go to the formula in Cell I119 on the data entry tab and change the reference there from K156 to K165.

R1 Dated 06/02/2025, This is the first release related to some of the provisions in HB 2. Please keep in mind that a final version of the bill is not available as of this date and has not been signed into law by the Governor. Also, please read the Notes tab before entering data. More releases will become available in the near future. Again, please be advised that all the calculations are subject to change and final school finance provisions will not become official until after HB 2 and other related bills are signed into law.

R4 Dated 05/01/2025, Current Law Plus HB 2, corrects a cell reference error that pertained to the calculation of ASAHE for 25-26 and was causing it to be significantly overstated in some instances (see Notes tab). Again, please be advised that all the calculations are subject to change and final school finance provisions will not be known until after a school finance bill is signed into law.

R2 Dated 05/01/2025, Current Law Only, only reflects current law for all years and corrects a couple of errors found in Release 1 (see Notes tab).

R3 Dated 04/24/2025, Current Law Plus HB 2, corrects cell references that were inadvertently changed on some of the 25-26 calculations (see Notes tab). Again, please be advised that all the calculations are subject to change and final school finance provisions will not be known until after a school finance bill is signed into law.

R1 Dated 04/23/2025, Current Law Only, eflects current law for all years, as we won’t know what the school finance provisions will look like beginning with the 25-26 school year until a school finance bill is passed and signed into law.